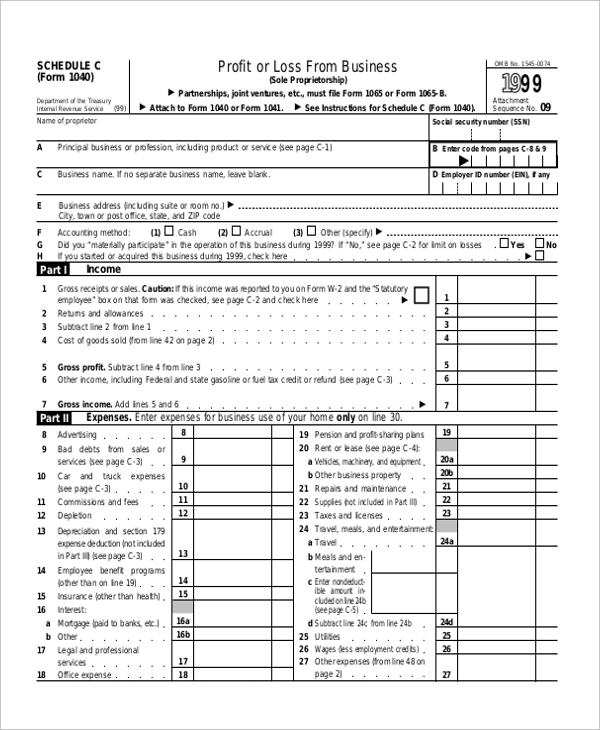

Here are some of the most notable deductions and exemptions that were eliminated for your 2018 tax year filing. So while your tax filing may be simpler, you may not be eligible for as many claims as before. The Tax Cuts and Jobs Act eliminated some of the deductions and exemptions that you could claim last year. Can You Claim the Same Exemptions and Deductions in the New IRS 1040 Form?

IRS 1040 FORM PROFESSIONAL

It’s recommended that you consult a tax professional for advice about your tax return filing and applicable schedules. Keep in mind that the form may change from now to your tax filing. The IRS aimed to make your tax filing more understandable than before. The new filing method will help you not forget deductions, claims or schedules you must file. Instead of filing the short or simple form, you will file the new 1040 and the applicable schedules. This form eliminated Form 1040-EZ and 1040-A. For the tax year 2018, you will only have to file the new IRS 1040 Form. Last year, you had the option to file the complicated IRS 1040, 1040-EZ or 1040-A.

Use our handy online calculators to see what your costs will be - and what your costs will be for health insurance - and what your penalty might be if you don't have it.

What Do Clean Water and Online Taxes Have in Common?īoth and Healing Waters International take the basics to the next level. Readįiling your taxes online is actually the safest way to handle your tax return, according to the IRS. ReadĬonfused about e-filing your taxes? Speed up your return filing with these tax tips. Heard the online banking buzz? Though traditional banks have their strengths, let's see what this online bank trend has to offer.

IRS 1040 FORM HOW TO

Some common mistakes on income tax returns - and how to avoid them. ReadĮ-filing is the safest way to handle your taxes. Here's what we found in our blog for file online with :Ĭheck our tax calendar to see exactly when your taxes are due.

0 kommentar(er)

0 kommentar(er)